Of all the challenges business owners face while shepherding their organizations, perhaps none is more emotionally charged than that of making the decision to sell. In the case of multi-generational family-owned and run businesses, making that call can be even more difficult.

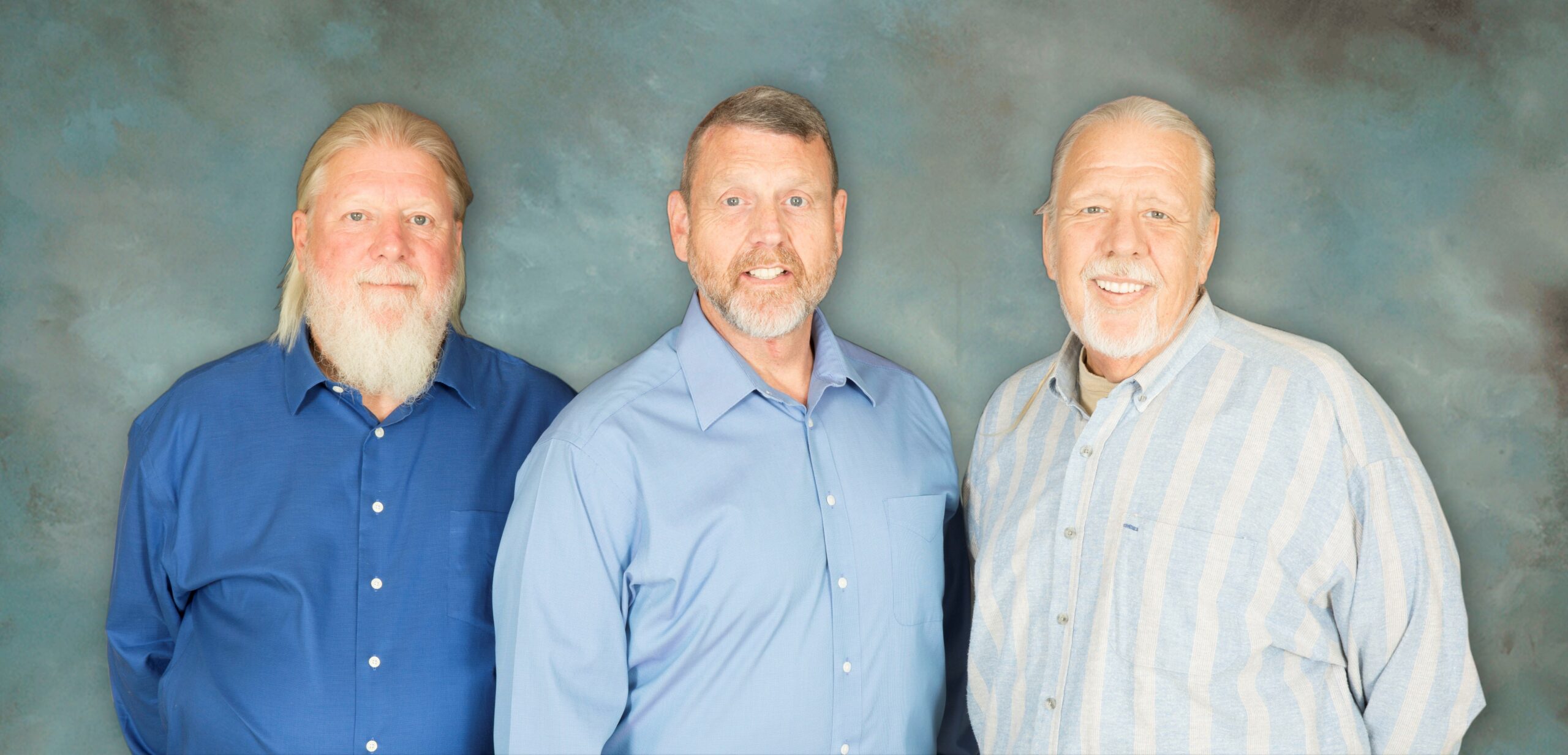

Perhaps nobody understands this better than Tom and Wally Trepp who recently sold their Tulsa, Oklahoma-based family business Prescor to Canerector. Since 1969, Prescor has been one of North America’s leaders in manufacturing tank heads for pressure vessels. The company was founded by John Trepp and then handed down to his sons after his passing in 1994.

Over the years, the Trepps heard numerous offers from interested suitors, but the timing never felt right. Wally Trepp admits that part of the hesitancy was the responsibility he felt towards his people and their families.

“When you have 50 employees, you feel a sense of responsibility that comes with that. You’re aware of how decisions you make affects their spouses and kids. I didn’t want to see a new owner come in and wreck the place and sell off machinery,” he said.

Of all the potential buyers that knocked on their door, only one seemed like a potential good fit when the day came to sell.

“We liked Canerector’s approach. They are a family-owned business themselves and they have a proven track record of helping the companies they buy grow. So, we liked the idea of being able to sell to someone who would pretty much leave things the same, and leave our employees in place, while taking the business to the next level,” Wally said.

A legacy of honouring legacies

Canerector embraces a purpose-led approach to growth, both through acquisitions and reinvestment in its businesses. “We believe manufacturing is the backbone of North America’s economy and we work hard to help it thrive,” said Amanda Hawkins, Canerector’s Executive Chairman. It helps that the company has zero-debt and the financial firepower to back this up.

“We value the histories, legacies and teams that built these businesses and empower them to operate autonomously, setting their own strategies,” explains Hawkins. “When we bring a new company into the Canerector family, we take a long-term view, support them, and have no interest in selling or exiting.”

Another important aspect to the Canerector approach is not spreading themselves too thin. They do this by adopting the business philosophy of ‘grow where you know’.

“We stay within our lane. Canerector has over 75 years of industrial products and services experience, so we focus on buying those types of companies,” explains Daniel Lee, Vice President, Acquisitions. “That’s where we’ve had success and that’s the space we know.”

The team from Canerector checked in on the Trepps on multiple occasions over the years. From the outset, they made it clear that Prescor was a business Canerector wanted to be involved with.

“Prescor had the family name. It was well known if you need to buy a head for your vessel manufacturer, you can call Prescor. They have an excellent reputation in the industry and a thriving work culture and that’s why they were attractive to us,” Lee said.

Those discussions, while not concluding with a deal, did plant a seed in the Trepp brothers’ minds.

“Even though we weren’t ready to sell, all those calls put in the back of our head that if the time to sell ever came, Canerector would be somebody we would want to talk to,” Tom said. “Not necessarily that they would be the ones, but we wanted to keep them in mind because we grew to trust them and liked what they said.”

Laying the groundwork for transition

Throughout discussions between Canerector and the Trepp brothers, the challenges of project management and costing systems came up. At the time, Prescor was still using index cards to track jobs through shops and had no way of aggregating data. The Trepps knew they had to address it and had a solution in mind. That solution came in the form of Sonja Wilson who was brought in to consult on the business.

“I started working with the Trepps as a consultant with a firm that helps owners develop their business,” she said. “I quickly discovered I wanted to join the business full-time because I knew my experience as a CFO could really help,” she continued.

Wilson helped the business flourish, and as time passed, the Trepp brothers began to feel increasingly comfortable about the prospect of moving on. The business was doing well, and they could rest assured knowing their people would be taken care of long after they moved on.

The next time Canerector touched base, they were impressed by what they saw. “A lot of the moves Sonja put in place were exactly what the company needed,” said Lee. “We also knew she would be a steady hand of continuity should the brothers one day decide to sell.”

Following the sale of Prescor to Canerector in May 2023 Wilson played a huge role in easing some of the trepidation amongst the employees.

“I have gone out of my way to stress that we still have local control,” Wilson said. “Yes, some things need to change, but it’s for the good. Canerector respects our local autonomy while bringing necessary improvements.”

Part of those improvements involved modernizing operations on the factory floor.

“The ERP system was very scary at first.” Wilson explains. “Now we’re using barcodes and all kinds of technology that help us every day, thanks to Canerector’s support.”

For the Trepp brothers, life after the sale has been marked less by wild new adventures and more by the peace of mind that comes with being able to disconnect from the day-to-day stressors of running a business.

“Our cousin asked me how things were going there a while back, and I said, I don’t know,” Wally shared. “It’s now at the point where it’s not my business and, in a way, not my worry.”

“Our cousin asked me how things were going there a while back, and I said, I don’t know,” Wally shared. “It’s now at the point where it’s not my business and, in a way, not my worry.”

“This is a pretty tight-knit community so if something was going wrong, I’m sure we would have heard about it. It’s nice to know we left it in a condition where things continue to run smoothly,” Tom added.

Hawkins believes the Prescor story is a great example for how acquisitions should play out as a win-win scenario.

“Being part of a multi-generation, family-owned business myself, I have a real appreciation for what it means to carry on that legacy. We’re proud to have Prescor join the Canerector family, and I look forward to achieving amazing things together for years to come.”